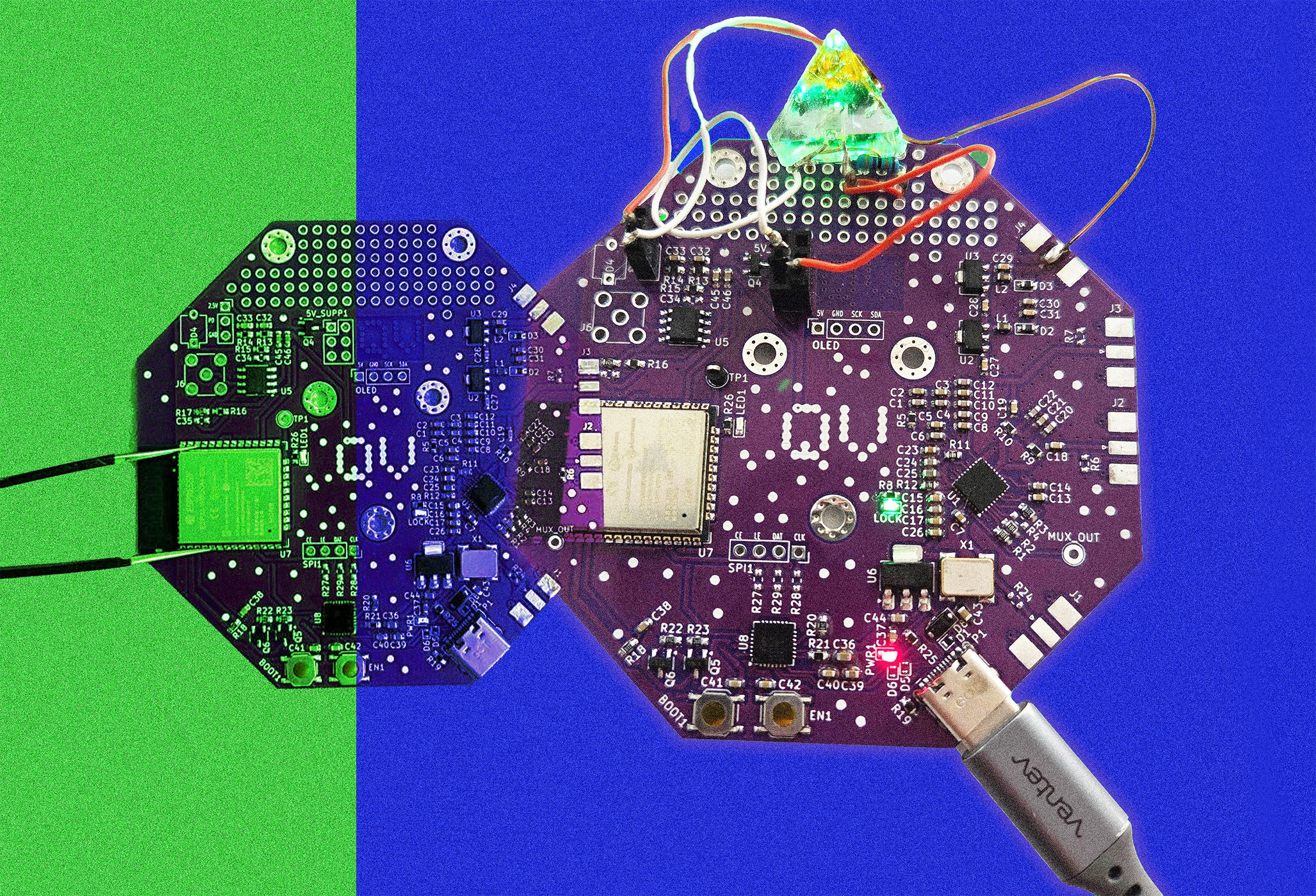

How to Protect Yourself From Portable Point-of-Sale Scams

…

How to Protect Yourself From Portable Point-of-Sale Scams

Portable Point-of-Sale (POS) scams have become increasingly common in recent years, with scammers targeting unsuspecting individuals through fraudulent transactions using handheld card readers. To protect yourself from falling victim to these scams, here are ten tips to keep in mind:

- Avoid sharing your PIN or personal information with anyone, including merchants using portable POS devices.

- Always verify the merchant’s identity and legitimacy before making a payment using a handheld card reader.

- Monitor your bank statements regularly for any unauthorized transactions or unusual activity.

- Use contactless payment methods whenever possible to reduce the risk of card skimming or cloning.

- Keep your credit and debit cards secure at all times and never leave them unattended.

- If a merchant asks you to enter your PIN multiple times, consider canceling the transaction and reporting the incident to your bank.

- Be cautious when using public Wi-Fi networks to make payments through handheld card readers, as these connections may not be secure.

- Report any suspicious activity or potential scams to your bank, local authorities, or consumer protection agencies.

- Educate yourself about common scams and stay informed about the latest trends in fraud prevention to protect yourself and your finances.

- Consider investing in fraud protection services or identity theft insurance for additional peace of mind.

By following these tips and staying vigilant, you can reduce the risk of falling victim to portable Point-of-Sale scams and protect yourself from financial fraud.